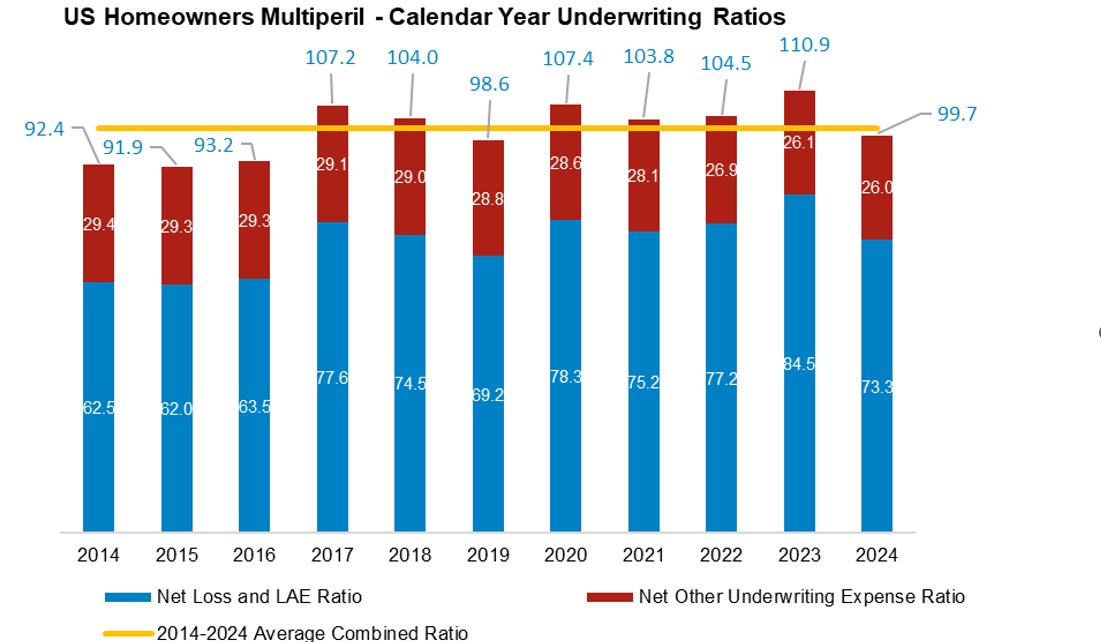

Last year’s sub-100 combined ratio for the homeowners line broke a five-year string of 100-plus figures for the U.S. insurance industry in aggregate—and homeowners insurers are sticking to rate increases to keep profits going, a new report says.

According the report from AM Best, “Improved U.S. Homeowners Results Challenged by January Wildfires,” total U.S. homeowners direct premiums written increased by 10.7 percent in the first quarter of 2025 compared with the same period in 2024.

This comes after the segment posted double-digit direct premium increases in each of the last four years. While the 10.7 percent is lower than first-quarter 2022, 2023 and 2024 premium boosts, which each averaged around 13 percent, in 2025, first-quarter premium was almost $15 billion higher than it was just four years prior in 2021, the report states.

“The increase in direct premium in the first quarter of 2025 shows that insurers are continuing to pursue adequate premiums in order to establish more favorable underwriting results for the U.S. homeowners insurance line rather than having the marked improvement in 2024 prove to be a one-year phenomenon,” said David Blades, associate director, AM Best, in a statement about the report.

That may be a tall order.

Measured against a full-year 2024 homeowners net loss and loss adjustment expense ratio of 77.3, the direct loss ratio for first-quarter 2025 was 102.1—a consequence of the January 2025 California wildfires and billions of dollars in losses from several tornado outbreaks in the Midwest, South and Plains states. (Editor’s Note: The comparison in the prior sentence is not apples-to-apples. The 102.1 excludes reinsurance recoveries.)

The current 2025 Atlantic hurricane season, which stretches through November 30, will provide yet another test for how well insurers have underwritten the risks that remain in their portfolios, the report notes.

In a media statement, AM Best cited another potential headwind for insurers—the erosion of the capabilities previously offered by the National Oceanic and Atmospheric Administration. Noting, for example, that the NOAA will no longer update a free, public database of $1 billion-plus climate- and weather-related disasters, Best said this “could create a critical gap for insurers, agents, brokers and policyholders that rely on catastrophe data and information that is instrumental in pricing, reinsurance planning, and identifying geographic exposure trends.”

The report also delves into the variability of homeowners underwriting results by carrier and by state. It includes an analysis of the number of states for which combined ratios surged past 100 in each of the past 10 years, showing 10 states topping the breakeven ratio in 2024. Further analysis in the report offers a comparison of 2014 and 2024 combined ratios for those 10 states—Nebraska, New Mexico, Georgia, South Carolina, Missouri, Arkansas, Oregon, Illinois, Oklahoma, and North Carolina. All have worsened, with combined ratios in these state rising 30 points, on average. (Illinois was an outlier with less that 1 point of deterioration.)

Top 20 Homeowners Insurers

Among carriers, AM Best “believes the segment’s better performers are more effective at leveraging technology to enhance underwriting, loss prevention, and service capabilities, particularly strengthening the risk selection process,” the report says, highlighting these activities beyond significant rate activity and inflation guard adjustments as some of the keys to better underwriting results.

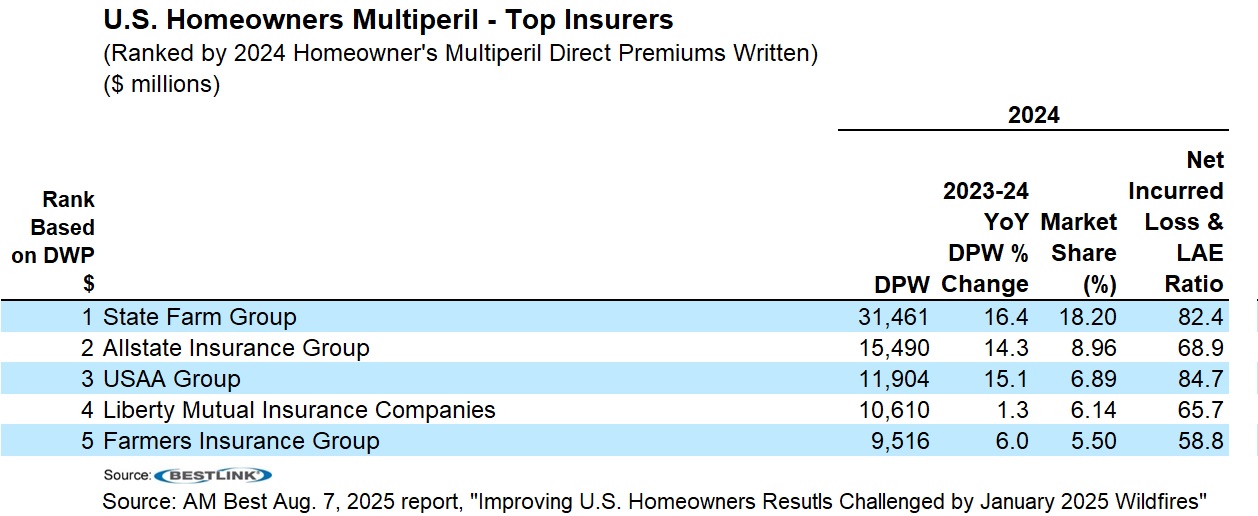

The report includes a list of the top 20 homeowners insurers by 2024 direct premiums written, including each carrier’s 2024 and 2023 direct premiums, market share and net incurred loss and LAE ratios.

Below we have excerpted the top 5 by 2024 direct premium volume.

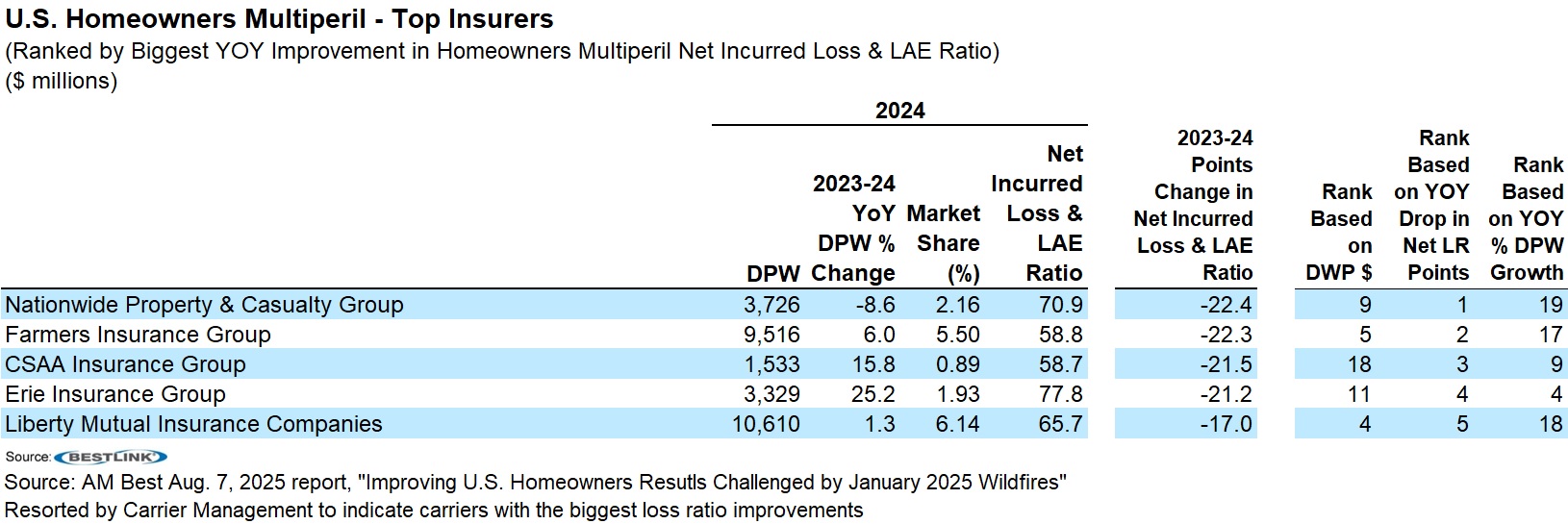

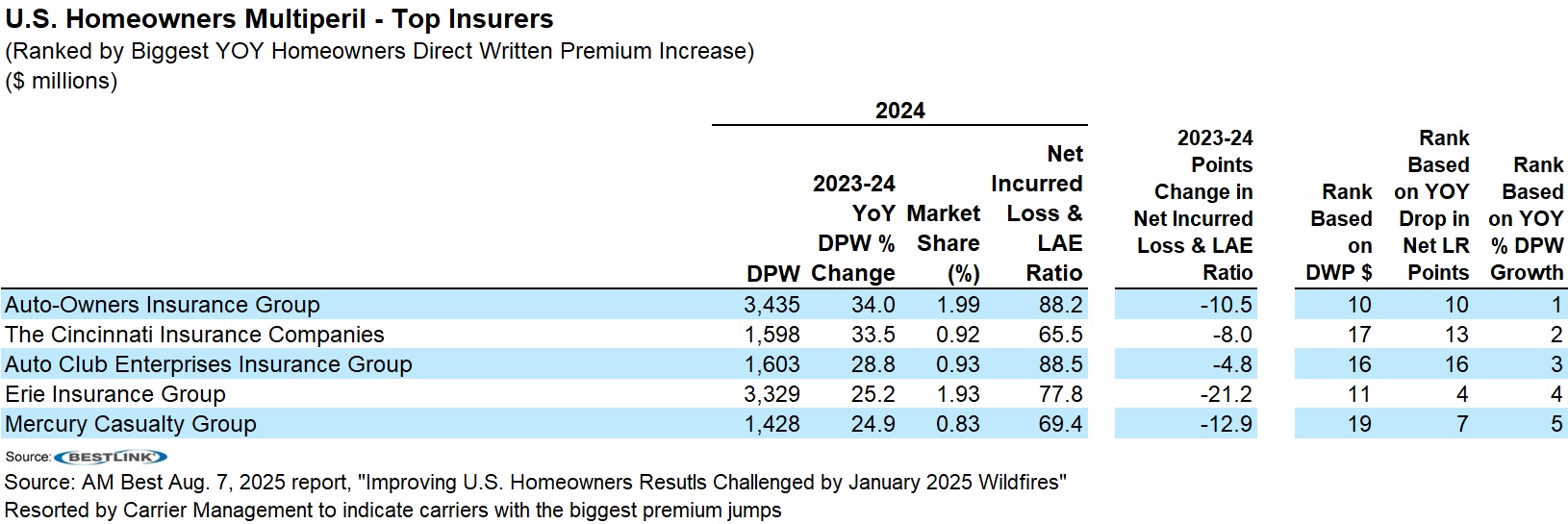

Using year-over-year net loss & LAE ratio changes from 2023 to 2024 (calculated by Carrier Management from information in the AM Best report), and percentage changes in direct premium written (calculated by AM Best), we also show the leaders based on those metrics—the biggest improvements in net loss & LAE ratios, and the biggest percentage jumps in premiums.

While the premiums are presented on a direct basis and loss ratios on a net (after reinsurance) basis, presenting some difficulty in drawing definitive conclusions, it is noteworthy that three of the carriers in the top quartile of net loss ratio improvement—Nationwide, Farmers and Liberty Mutual—rank in the bottom quartile of direct premium growth. While 13 of the top 20 carriers grew direct premiums by double-digits, Nationwide shrank 8.6 percent while improving its net loss ratio more than 20 points. Farmers likewise saw a 22 point drop in its loss ratio from 2023 to 2024, but grew direct premiums by just 6 percent.

Actions by carriers to reshape their books of business by shrinking or exiting some regions in addition to taking rate may have fueled some of the loss ratio improvements.

Only Erie Insurance ranks in the top quartile for both loss ratio improvement and premium growth. Meanwhile, two writers prominent in the state of Florida, Citizens Property Insurance Corporation and Universal Insurance, were both in the bottom quartile of loss ratio improvement and premium growth. A depopulating Citizens, in fact, reported 15.3 percent less direct premiums in 2024 than 2023, but a hurricane-impacted loss ratio of 130.8—more than 80 points above 2023.

Among the top 5 carriers ranked by direct premium volume, USAA moved past Liberty Mutual to take a third-place ranking in 2024. USAA’s homeowners premiums grew 15.1 percent to $11.9 billion, behind the top players—State Farm and Allstate—which also each reported growth in the mid-teens.

Growing twice as much last year were Auto-Owners Insurance Group, The Cincinnati Insurance Companies and Auto Club Enterprises Group, which all saw direct written homeowners premiums up around 30 percent.