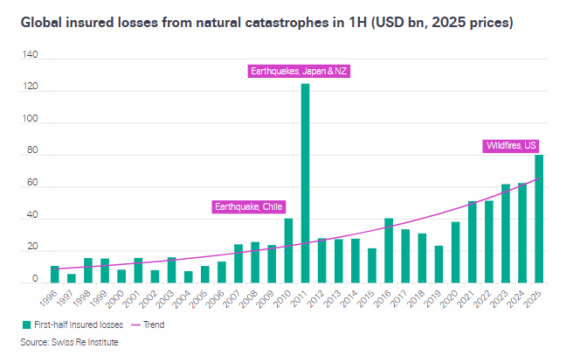

Global insured losses from natural catastrophes hit US$80 billion in the first half of 2025, which is almost double the 10-year average between 2015 and 2024 and marks the fifth year in succession when H1 losses have exceeded $US50 billion, according to Swiss Re Institute’s preliminary estimates.

Insured losses from natural catastrophes have been growing at a long-term trend rate of 5‒7% annually in real terms, said Swiss Re, noting that if this trend holds, claims from natural disasters this year will likely approach $150 billion.

However, Swiss Re Institute said total insured losses for the year could exceed its $150 billion projection because natural catastrophe activity is typically higher in the second half of the year when 60% of annual natural catastrophe insured losses historically occur due to the hurricane season.

Swiss Re’s estimates for the first half of 2025 and the full year were published in its report titled “Unseasonal fires trigger above-trend catastrophe losses in first half 2025.”

Unprecedented claims from wildfires in California and large thunderstorms in the U.S. led to the second costliest first half ever for global insured losses, following the record-breaking first half of 2011 when a tsunami in March of that year caused a major nuclear accident at the Fukushima Daiichi Nuclear Power Plant on the northeast coast of Japan and a major earthquake hit Christchurch, New Zealand in February.

Swiss Re’s estimated insured loss numbers for H1 2025 were level with those released by Munich Re on July 29 and $20 billion lower than those reported by Aon in mid-July.

All three nat-cat reports said H1 global insured losses were driven by California wildfires and severe convective storms (SCS) in the U.S.

Wildfires

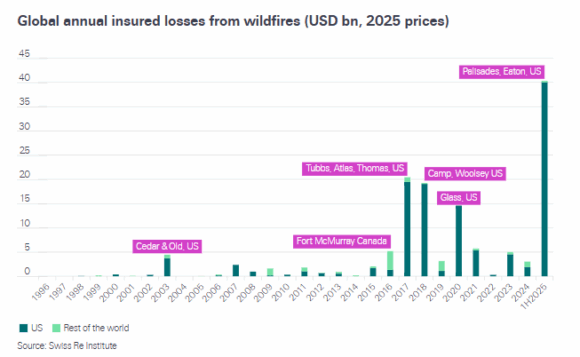

The wildfires that swept through parts of Los Angeles County in January brought the highest-ever insured wildfire loss event – with estimated claims of $40 billion, or half of the global H1 insured loss price tag and among the top 10 costliest natural disasters in Swiss Re’s records.

This “exceptional loss severity was due to a prolonged Santa Ana winds season coupled with a lack of rainfall…,” Swiss Re said, explaining that the fires spread rapidly and destroyed more than 16,000 structures in an area with some of the densest concentration of high-value single-family residential property in the U.S.

Losses from wildfires have risen sharply over the past decade, which Swiss Re attributed to the lethal convergence of rising temperatures, more frequent droughts, changing rainfall patterns and high-value asset concentration.

“Prior to 2015, on average wildfires across the world contributed around 1% of the total insured losses from all natural catastrophes. In the last 10 years, this has risen to 7%, the costliest periods being a two-year stretch of 2017‒18, and to a lesser extent 2020,” the report said, noting that 8 of the 10 costliest wildfire insured loss events have all occurred in the last decade (after adjusting for inflation).

“Due to the combination of high hazard and high value asset concentration, most fire losses originate in the U.S. and particularly in California, where expansion in said regions has been high,” Swiss Re said. “Since 1990, exposure growth in the high-risk wildland urban interface (WUI) zones has outpaced exposure growth in non-WUI zones by a factor of 1.8 in the U.S., and by a factor of 1.9 in California.”

Swiss Re said the January wildfires in California were unusual in that they occurred in the winter season, typically the state’s wet season. “Historically, the biggest wildfire loss events in California have occurred during the hot and dry late summer and autumn months, after which cooler temperatures and rains serve to dampen fire risk.”

Based on records from sigma (Swiss Re’s research arm) 99% of the wildfire losses that originate in California occur in the second half of the year.

Severe Convective Storms

Severe thunderstorms with large hail and tornadoes – or severe convective storms – led to global SCS-related losses of $31 billion during the first half, which is below the trend estimate of $35 billion and also below SCS losses reported in H1 2023 and 2024, Swiss Re said.

Although SCS losses have so far been below trend, Swiss Re said, there is no reason to believe that they will not continue “to be a major driver of global natural catastrophe insured losses.”

“Only a decade ago insured losses triggered by SCS were trending at around $20 billion,” the report continued.

Swiss Re attributed the growth in SCS losses to urbanization in hazard-prone areas, rising asset values and inflation (mainly due to construction costs), which have amplified the financial impact of these severe thunderstorms.

On average, at least 70% of the losses from SCS originate in the first half of the year with June marking the end of peak thunderstorm activity across the central U.S., said Swiss Re, noting that, historically, first-half losses from SCS have never been below 50% of the full-year total.

“That said, significant severe weather activity might continue through the year and large events can happen in the second half too, also outside of the US. The US is particularly prone to SCS due to its geography, but large-scale cost events can happen in Europe too, as in the case of Italy in July 2023,” the report warned.

Other findings from the Swiss Re report include:

- Economic losses from natural catastrophes in the first half of 2025 were US$135 billion, of which insurance covered about 59%. During H1 2024, economic losses were $130 billion. (Economic losses include insured losses).

- Economic losses from man-made events were $8 billion during the first half, which is level with the same period last year. (These figures were contained in the press release accompanying the report).

- Insured losses from man-made events during H1 were $7 billion, level with the same period last year.

- Construction costs in the U.S. rose by 35.64% from January 2020 to June 2025, directly affecting property claims costs.

- The magnitude 7.7 earthquake that hit Myanmar in March brought shockwaves were felt as far away as Thailand, India and China and caused estimated insured losses of US$1.5 billion in Thailand alone.

- In the past 30 years, 60% of the total natural catastrophe insured losses originated in the second half on average, mostly due to costly TCNA (Tropical Cyclone North America) activity in the third quarter, such as during the years 2004, 2005, 2008, 2017 and 2022.

- Current Mediterranean sea surface temperatures are 3°C above the historic average, the warmest on record, which could lead to higher-than-usual rainfall levels in autumn, potentially triggering large-scale floods in Europe, said the report, quoting an article from Severe Weather Europe, titled “Mediterranean Marine Heatwave brings water temperatures at record levels.”

Authors of the report are: Dr. Chandan Banerjee, natural catastrophe economist, Swiss Re Institute; Lucia Bevere, senior catastrophe data analyst; Dr. Shilpa Gahlot, insurance research specialist, Swiss Re Institute; and Dr. Mahesh H Puttaiah, head insurance market analysis, Swiss Re Institute.

Photograph: The Palisades Fire burns vehicles and structures in the Pacific Palisades neighborhood of Los Angeles, Jan. 7, 2025. (AP Photo/Ethan Swope, File)

Related:

Topics

Natural Disasters

Trends

Profit Loss