Neptune Insurance Holdings Inc. is hoping its record of growth and profitability selling flood insurance policies will generate the same investor enthusiasm for its US IPO that greeted most debuts by other firms in the sector this year.

Like many of them, the St. Petersburg, Florida-based company is shaking up a niche form of property and casualty insurance. Neptune offers a hard-to-sell type of coverage in which the US Federal Emergency Management Agency-run National Flood Insurance Program holds a dominant 90% market share.

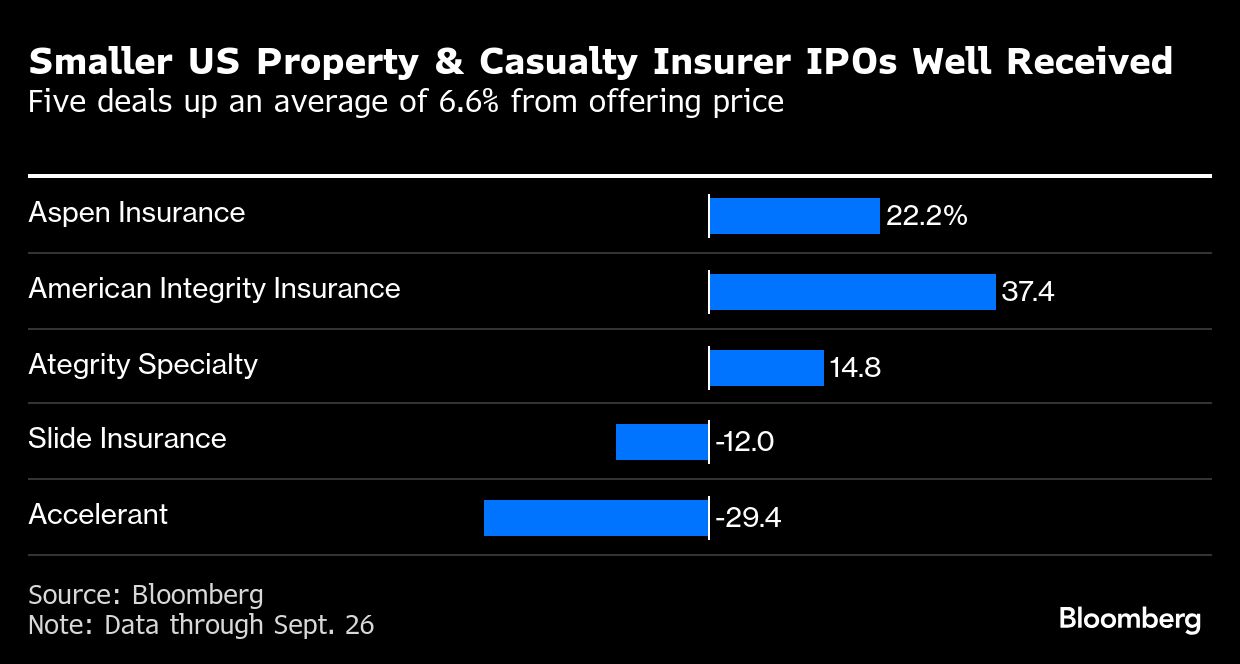

Neptune is set to become the sixth US-based insurance-sector company to go public this year. With three of the five listed firms trading above their IPO prices, investors are increasingly willing to bet on firms using artificial intelligence and big data to meet demand for better coverage against risks such as from the effects of climate change.

“As the pipeline has come out, what’s been revealed is there’s a number of small cap players with differentiated business models that occupy a unique niche in the public markets,” said Warren Fixmer, Barclays Plc’s equity capital markets banker focused on sectors including insurance.

Some small-cap insurance IPOs of the past have proved spectacular winners. Specialty insurer Kinsale Capital Group Inc. has returned more than 2,500% to investors since its 2016 IPO, while Skyward Specialty Insurance Group Inc.’s shares have tripled since it debuted in early 2023.

Neptune is a so-called managing general agent, selling coverage via an agent network on behalf of other insurance and reinsurance companies that take on all the risk and handle and pay out the claims. More than three-quarters of Neptune’s revenue comes from commissions for writing policies and it carries no direct claims exposure itself, according to its US Securities and Exchange Commission filings.

To come up with instantaneous risk-adjusted insurance quotes, Neptune uses machine learning, geospatial analysis and big data rather than human underwriters and outdated flood maps.

Neptune’s initial public offering, which could raise as much as $368.4 million for shareholders including Bregal Sagemount and FTV Capital, has drawn institutional demand for more than 10 times the available shares ahead of pricing late Tuesday, people familiar with the matter have said.

At the top of the marketed price range, Neptune would command a base market value of $2.8 billion, a lofty multiple of its adjusted earnings before interest, taxes, depreciation and amortization of $82 million and revenue of $137 million in the last 12 months ended June 30, partly reflecting its strong growth rate of roughly 40% alongside outsize margins of around 60%.

What Neptune lacks is scale. It had just 244,964 policies in force at the end of June and held only 7% of the primary residential flood insurance market. Yet with only a fraction of the US’s 100 million-plus homes and commercial buildings insured for flood risk, there’s room for growth as more building owners see the value of coverage against the most common and costly type of natural disaster.

In a roadshow presentation for the IPO, Neptune management led by Chief Executive Officer Trevor Burgess — a former Morgan Stanley banker and C1 Bank CEO — said the company had withstood 21 landfall hurricanes since it started business in 2018 and has delivered a life-time loss ratio of less than 25%. The ratio measures actual and expected claim losses as a percentage of premiums. In contrast, the NFIP’s loss ratio over the same period was 86%, according to Neptune’s IPO filing.

And unlike a federal agency, the company can pick and choose its clients.

“There will be some selection bias because they do get the best risks, but if you are FEMA you have to take everybody,” said Matthew Palazola, Bloomberg Intelligence’s property & casualty insurance analyst for the Americas.

Copyright 2025 Bloomberg.

Interested in Carriers?

Get automatic alerts for this topic.